RBL Bank is one of the few Indian credit card companies that offers a diverse range of credit cards. They have practically every form of credit card to offer us, from premium to entry-level. The RBL Platinum value plus super card will be discussed in this article.

This card is created specifically for consumers who wish to receive cash back on their purchases. Aside from reward points, this card excels at providing fuel fee exemptions, lost card liability coverage, and a slew of other convenient credit card features. The yearly charge for this card, which is powered by MasterCard, is Rs. 499. The perks of the Bajaj finserv rbl bank supercard are explored further below.

Value Plus Bajaj Finserv RBL Bank Platinum Plus Supercard Eligibility Criteria:

- Resident Type: Indian.

- For salaried person:

- Age: 21 to 60 yrs.

- Income: Above Rs. 25,000 monthly.

- For self-employed person:

- Age: 21 to 65 yrs.

- Income: Above Rs. 25,000 monthly.

- Good CIBIL Score (750 or more).

You can apply for this card online at the Bajaj Finance credit card apply website, and once your application is approved, you can check the status of your credit card at the RBl card status monitoring page.

Documents Required To Apply For Value Plus RBL Bank Supercard:

- Photocopy of ID Proof (any 1)

- Aadhar card

- Voter Card

- Passport

- PAN Card

- Photocopy of Address proof (any 1)

- Last 6 months bank account Statement

- Aadhar Card

- Driving License

- Passport

- Utility bill

- One recent passport-sized photographs

- Proof of income statement:

- Salaried Person (any 1)

- Latest salary slip, (3 months)

- ITR(Income Tax Return)

- Self-employed person

- Latest Income tax return.

- Proof of business

- Recently audited financial report.

- Salaried Person (any 1)

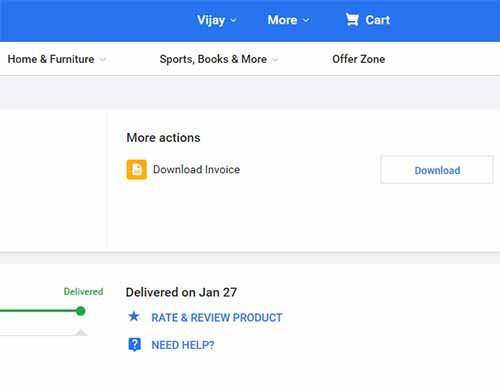

All new Bajaj finserv credit cards are delivered in an inactive status, as per the new credit card rules. You’ll also need to generate a new rbl credit card pin before you can use your new bajaj finance card. The cashback beta faq page can assist you with the rbl bank credit card first-time pin generating process.

Value Plus RBL Bajaj Supercard Fees:

- Bajaj finserv rbl bank platinum plus supercard joining fee: Rs. 499 + GST

- Bajaj finserv value plus rbl super card annual fee: Rs. 499 + GST

Value Plus Bajaj Finserv RBL Bank Supercard Benefits:

- Welcome benefit:

With the issuance of this rbl super card, RBL extends a generous welcome gift of Rs. 500 in the form of a gift certificate. To qualify for this offer, you must pay your annual fee on time and spend at least Rs. 2000 on this card within 30 days of receiving your Value plus credit card.

Cashback benefit:

You will receive 10% cashback on all fuel purchases if you use your RBL platinum value plus super card. This offer is valid at the majority of India’s petrol stations.

Fuel surcharge waiver:

As with this RBL bajaj finserv credit card you will get up to Rs. 100 off on fuel surcharges. That means you can now travel long distances more freely.

Lost card liability:

RBL Bank provides liability coverage for lost cards on this super card. So, if your card is lost or stolen, all you have to do is phone the RBL card customer service hotline to report it. You can also use your bajaj finserv rbl bank super card net banking account to temporarily block your rbl bajaj finserv card.

Milestone benefit:

If you spend Rs. 1,00,000 on this card in a year, you will receive a Rs. 1,000 gift voucher. The gift voucher is simple to use, and the cash back will be paid to your Value Plus Bajaj credit card account.

Opportunity to make your card lifetime free:

You can request a complete refund on your annual membership cost. To qualify for this offer, simply spend Rs. 50,000 on this card within a year and the annual fee for the Value plus bajaj finserv rbl credit card will be waived for the next year. So, if you want to convert your car into a rbl lifetime free credit card, you only need to spend Rs. 50,000 per year.

Add-on facility:

You may now tell your friends and family about the fantastic benefits of your Bajaj rbl card. Simply add your loved ones (children, parents, siblings, or any family member over the age of 18) to your card and they will be able to take use of the fantastic bajaj finserv rbl bank supercard features.

RBL credit card balance transfer facility:

You can now get a better deal on your dues by paying a reduced interest rate. Simply move your other card’s dues to your Value plus rbl bank supercard and you’ll benefit from a cheaper interest rate.

Easy expense control:

You can enjoy a flexible spending limit with this Value plus rbl platinum super card. You can establish a spending restriction for yourself by downloading and registering the MyCard app.

Easy PIN setup:

It’s now incredibly simple to set up a pin. You may set your bajaj finserv new card pin in a few simple steps using the RBL MyCard app. You can also set your pin online; simply log in to your account on the Bajaj finserv rbl bank supercard login page, pick ‘Online Services, then select ‘Set your Card Pin.’

Anytime cash withdrawal:

With your Value plus bajaj rbl platinum super card you can withdraw cash against your credit limit whenever you need it. Applicable charges 2.5% against the amount.

Easy expense control:

Through the MyCard App, you can now manage your Bajaj finserv rbl supercard account online. With this card, you’ll get access to all of the features. You may pay your bills, examine your transaction history, request a bajaj financing card statement, pay your EMI, and change your card pin, among other things.

Convenient bajaj finserv rbl bank supercard payment options:

It is now incredibly simple to pay your credit card bill. You can pay with your rbl bank credit card using net banking, My card app, or any other secure credit card payment app.

Platinum security:

A built-in EMV chip is found on all Bajaj cards. This chip was created with the goal of increasing the security and convenience of credit card transactions. Your Value rbl bajaj finserv credit card is also protected by end-to-end encryption, which means you’ll require an OTP every time you make a transaction.

Global acceptance:

This Value plus rbl bajaj super card is intended to be accepted all around the world. This card can be used anywhere the MasterCard logo is visible.

RBL Value Plus Bajaj Finserv Card Charges:

| Particulars | Payable amount |

| RBL credit card cash withdrawal charge | 2.5% against the withdrawn amount, min Rs. 500. |

| Value plus rbl bajaj card finance charge | 3.99% monthly. |

| Value plus bajaj rbl card currency conversion charge | 3.5% against the transaction amount. |

| Value plus bajaj rbl super card add on card fee | None |

RBL Bank Supercard Customer Care Contact Details:

- Call the bajaj finserv rbl credit card customer care number: 022-6232-7777 or 022-7119-0900 (Super Card)

- Write to the rbl credit card customer care mail id: cardservices@rblbank.com

Cashback beta Ratings:

3.5/10

Final Opinion:

If you are looking for a card that can earn you big cash-back and rewards then this card is the best card for you. It comes with a huge number of features and benefits, at a very low cost. So if you are eligible and looking for a budget card then you must go for it, as it offers the best possible features at this price point.

But if you want to compare some alternative card options then I would suggest you take a look at the alternative card options given below.

Alternative Cards:

- BOI Swadhan Rupay Platinum credit Card. (Best for cashback)

- Kotak Mahindra Delight Platinum Credit Card. (Best for entertainment and fuel benefits)

- kotak fortune gold credit card (Best for fuel benefits)

- sbi bpcl credit card (Best for fuel benefits)